With so many people making contactless payments using a mobile phone, why would you bother designing a complex HMI or open – often unsecure – wireless connectivity into your payment terminal design?

That’s exactly what you should be asking when you consider this forward-thinking Bluetooth board from AuthGate – ipXchange has summarised some of the key benefits of the micro-TAD (Transaction Authentication Device) in another ePoster.

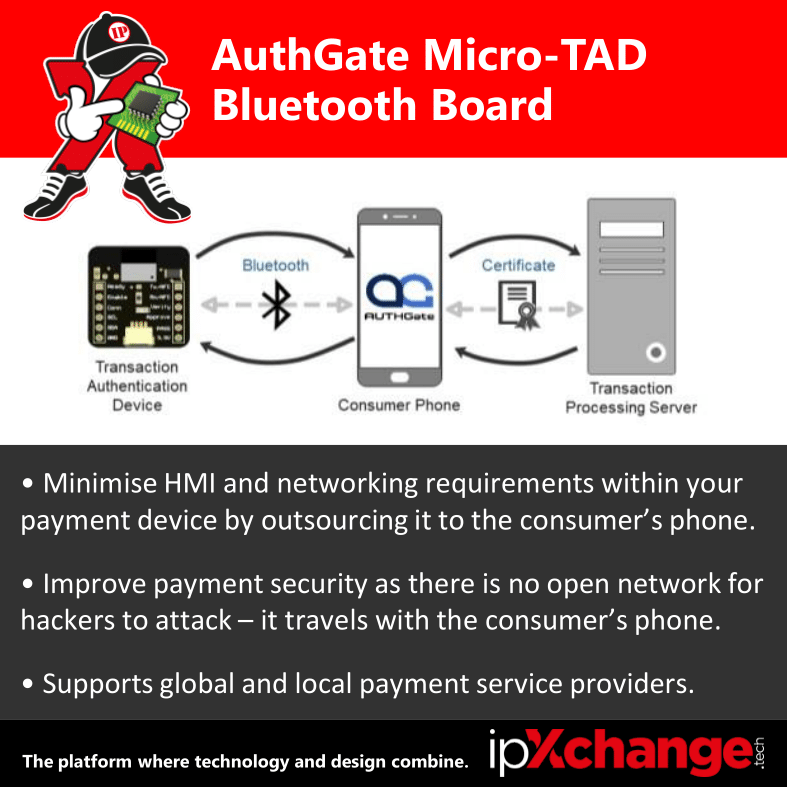

So, what does the micro-TAD do? In short, this 20 x 25 mm module connects to a consumer’s phone via Bluetooth in order for the user to make a payment or control the functionality of a mobile payment terminal directly from their phone, instead of by using an HMI built into the payment terminal. Additionally, it is now the user’s phone that connects to the payment server, rather than the payment terminal itself.

By moving all this functionality to the consumer’s device, AuthGate’s Micro-TAD greatly simplifies the requirements of the payment terminal and removes an easy target for hackers looking to exploit a connection to a payment server; that connection is now moving with the consumer. More so, screens and wireless connectivity are often the most power-hungry aspects of a payment terminal design, so for something like a smart locker, the requirements can be reduced to a simple actuator for a lock, which may even be able to run on a battery in the most remote deployments!

Obviously, the Micro-TAD is not going to be the replacement for the terminal in the supermarket down from the ipXchange offices, but there are plenty of other secure authentication applications for AuthGate’s disruptive little module, so learn more about it on the board page and apply to evaluate this technology.

AuthGate will be attending IFA Berlin this weekend, so go see them at Hall 27, Stand 760 if you’re attending.

Keep designing!